This post is written by Tim Hillegonds, a former insurance expert for NBIS, and contributor to American Crane & Transport magazine.

For those that are not in the crane insurance industry, it can seem like a complex and hard-to-understand system. Terms like risk management, loss mitigation, subrogation, and loss control are thrown around at random, and the policy holder is left trying to decipher what, exactly, those terms actually mean. To the average insurance buyer, though—even amid the misunderstandings—it usually boils down to one basic question: What can I do to reduce the amount of premium I pay?

The crane insurance industry—or the insurance industry in general—is really nothing more than a series of mathematical equations. Crane insurance providers will typically use what’s called “experience rating”—a process whereby an underwriter uses the company’s published pricing structure as a starting point, then adjusts it based on past loss experience to come up with a rate. That rate is then multiplied by an exposure unit to come up with a price.

In first-party coverage, that is, coverage that covers the crane owner’s equipment, the math gets even simpler. Typically, the rate is multiplied by the value of the equipment (usually per $100 of value, but sometimes per $1,000), and then adjusted based on losses. Keeping the math in mind then, having a loss history that reflects minimal losses is imperative to keeping your crane insurance premium as low as possible.

One way to help mitigate loss exposure is through the crane accident recovery process. When a crane turns over and the boom is lying across a job site, or worse, across someone’s backyard, most owners’ first reaction is to get the site cleaned up as quickly as possible. Crane company owners get worried about bad press and people talking. General contractors start screaming. Everyone just wants to remove the damaged crane and get on with his or her day.

While we understand the sensitivity involved in crane accidents, we also know that initiating the cleanup without properly assessing how the crane will be removed can have a significant effect on a crane company’s loss run. Ultimately, the amount the insurance company has to pay to repair or replace the damaged piece of equipment is the number that will be reflected on the loss run when the insurance renewal comes up again the following year. Mitigating the damage to the crane during the recovery process should be on the forefront of every owner’s mind.

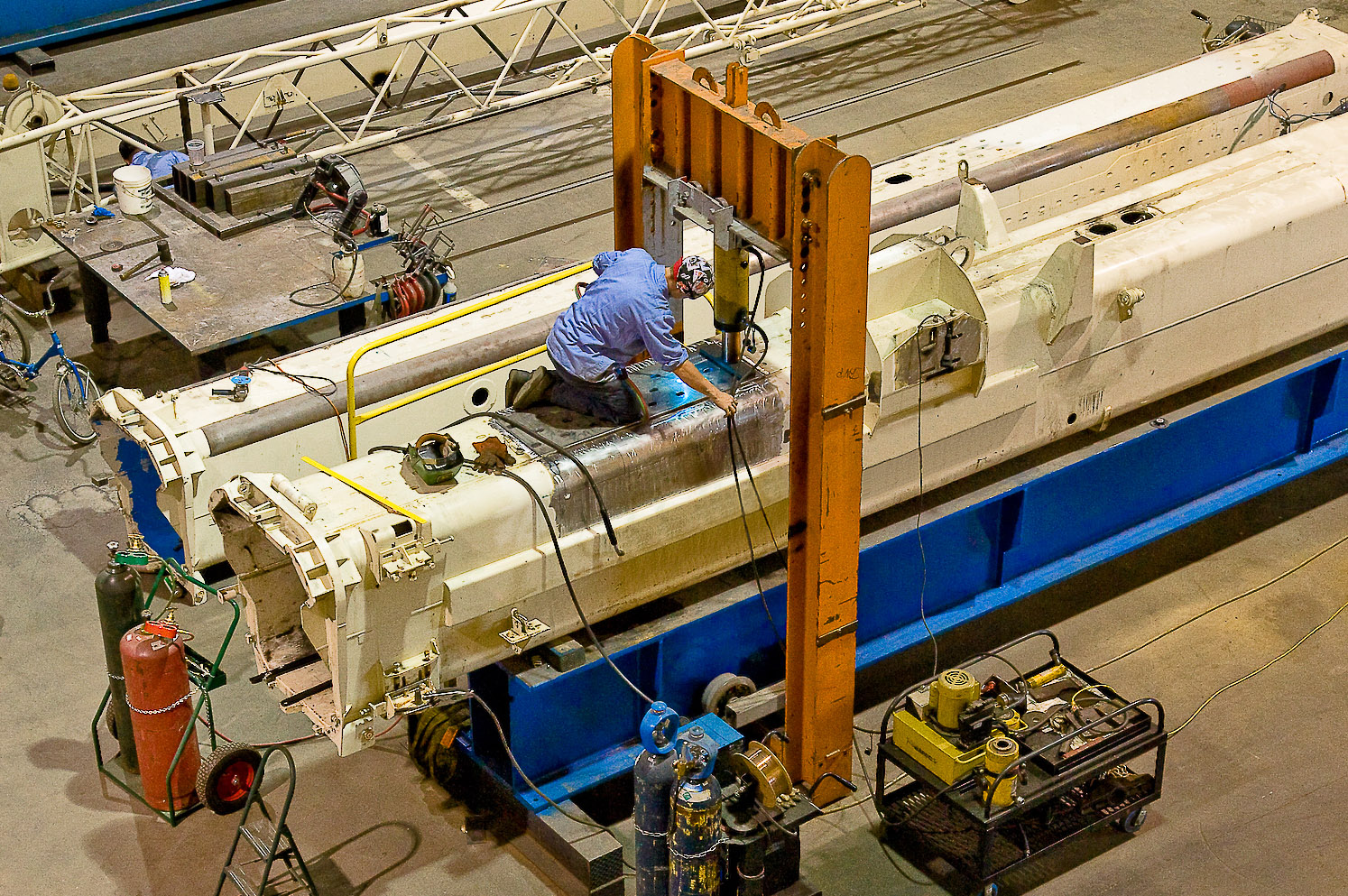

Most crane industry professionals know that the majority of a crane’s value may be found in its boom. To put this in perspective, consider the following scenario: The boom of a mobile hydraulic crane was lying across a roadway because it was side loaded, and tipped. The damage was mostly contained to the boom. In an effort to expedite removing the crane from the site, welders were called in to cut the boom. But because the boom was cut in half without any thought to where the cut was made, or to where the cylinder was located, the entire boom was rendered useless and had to be replaced. And in the process, a perfectly good, and very expensive telescopic cylinder, was also rendered useless. Had the crane owner spent a little more time planning the recovery process and placing the cut in an area that optimized the repair potential, a total replacement could have been avoided. In some cases this small procedural adjustment can easily add up to five and six figures savings. And since the amount the insurance company pays to repair the crane is what ends up being one of the determining factors in next year’s pricing, minimizing the damage caused during the recovery process is paramount.

Having a crane and heavy equipment repair expert supervise the recovery process is just one of the many ways that a crane owner can reduce the amount of premium paid for their crane insurance. Incorporating a supervised recovery process into your company’s mindset isn’t just a good business practice, though, it’s a way to endear yourself to your insurance company and show them you’re a risk that’s worth the savings.